Unveiling the Success Story: 47 Years and Beyond of Profitable Operations at Southwest Airlines

Exploring the Southwest Way of Sustained Profitability in the Airline Industry

In the wake of 81 years in operation, American Airlines found itself invoking Chapter 11 bankruptcy protection against its credit obligations. The eleventh day of September in 2001 emerged as a cataclysmic event in the annals of American history, sending shockwaves rippling across the globe. As a response, the entirety of air travel was abruptly halted, passengers gripped by an overwhelming fear of taking to the skies. The American aviation sector plunged into such dire straits that the very continuity of domestic air travel seemed perilous, with the major American Airlines hemorrhaging substantial sums, tallying millions of dollars in losses. The toll was severe, leading to the displacement of 46,000 jobs, and the situation grew so dire that even industry titans like United Airlines and US Airways found themselves compelled to seek refuge in bankruptcy proceedings.

Remarkably, amid this tempestuous period, one airline stood apart, resilient and unscathed by the turbulence. Southwest Airlines, a carrier of legendary repute, defied the prevailing bleakness and maintained an unbroken streak of profitability throughout 2001 and 2002. What sets Southwest Airlines apart is a marvel unto itself. The airline not only weathered these dire times but also sustained profitability over a remarkable 47-year span, encompassing two oil crises, the trauma of the 9/11 attacks, and the tumultuous terrain of the 2008 recession. This phenomenon raises the intriguing question: What are the distinctive attributes that render Southwest Airlines impervious to financial adversity during these trying business epochs?

In the realm of the aviation industry, the analysis of players involves a keen examination of the operational models they employ to connect various destinations.

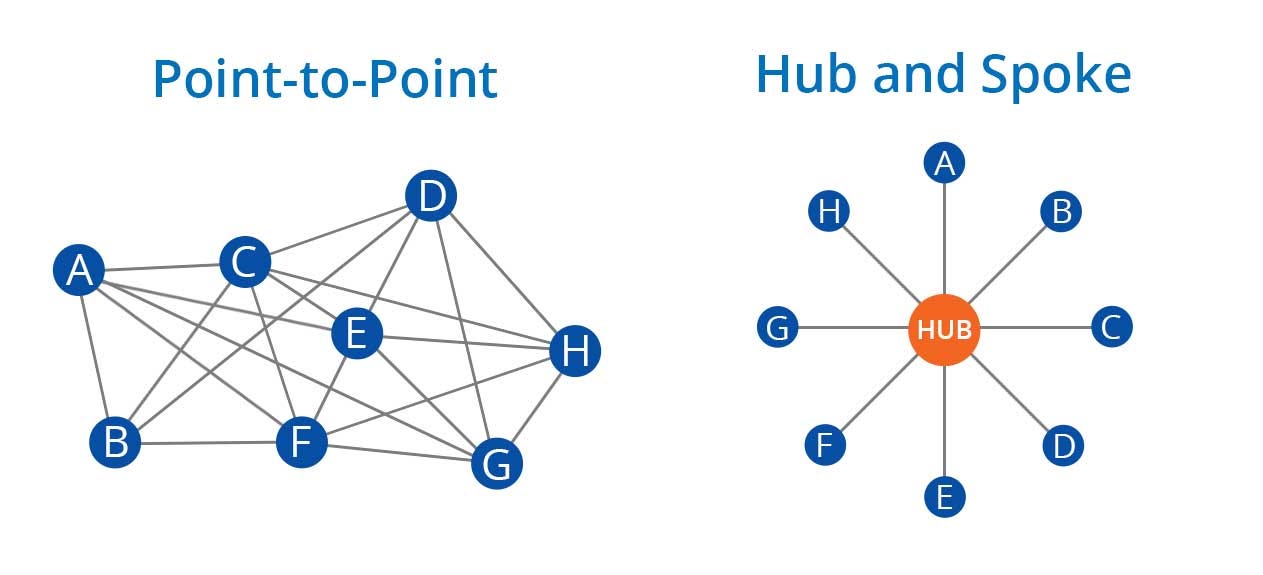

There exist two primary models that airlines utilize to facilitate these connections:

1. Hub and Spoke Model:

This model is the cornerstone of many traditional airlines' operations. It revolves around the concept of establishing one or more central hubs, typically major airports, where passengers from various origins converge. From these hubs, passengers are then routed to their final destinations. The hub serves as a central point for connecting flights, making it a pivotal element in the airline's network. This model is known for its efficiency in managing high volumes of traffic and allows airlines to offer a wide range of connecting flights, often resulting in a broader route network.

2. Point-to-Point Model:

In contrast, the point-to-point model is characterized by a more direct and simplified approach. Airlines following this model aim to connect passengers directly from their origin to their destination without the need for a central hub. This approach minimizes the number of layovers and reduces travel time for passengers. Low-cost carriers, in particular, have embraced the point-to-point model as it can lead to cost savings and more straightforward travel experiences.

The choice between these two models often reflects an airline's strategy, its target market, and its resources. Hub and spoke models are generally favored by larger legacy carriers with extensive route networks, while point-to-point models are often embraced by low-cost carriers seeking simplicity and cost-efficiency.

Understanding an airline's operational model is crucial in assessing its strengths, weaknesses, and its ability to cater to the diverse needs of passengers in the aviation space.

Let's consider the scenario with 8 destinations labeled as ABCDEFGH. If you wish to establish flights connecting all these destinations using a point-to-point model, here's how it works: You would need individual flights to go from A to B, B to C, C to D, D to E, E to F, F to G, and G to H. In this case, you'd require 20 flights to ensure connectivity between all destinations. In total, if you aim to connect all these 8 destinations, you would need 20 planes.

However, in the hub-and-spoke model, the task becomes more manageable. Instead of establishing separate flights for each destination pair, you create a central "HUB" where flights converge. Here's how this model operates: If you want to connect at the HUB to destination E, the process unfolds as follows. A single plane carries all passengers destined for DEF. Upon landing at the HUB, passengers disperse to their respective connecting flights, which are bound for BCDEFGH. These connecting flights then transport passengers to their respective destinations. This system ensures that all customers ultimately reach their intended endpoints.

While this might initially seem complex, there are four incredible benefits that the hub-and-spoke model offers over the point-to-point model:

Reduced Plane Requirement: The hub-and-spoke model requires only 8 planes, a significant reduction compared to the 20 planes needed in the point-to-point model to connect all 8 destinations.

Enhanced Plane Occupancy: With the hub-and-spoke model, planes are more efficiently occupied as you can serve the same number of customers with just 8 flights, maximizing resource utilization.

Simplified Maintenance: The presence of a central hub streamlines maintenance operations, making it easier to manage and service the fleet of planes.

Scalability: Expanding the network is straightforward in the hub-and-spoke model. You can add additional spokes by introducing more planes to the network, automatically connecting them to all 8 destinations via the hub.

Whereas if you want to add another destination to the point to point model you will need another 8 plane therefore the hub spoke model is that model which can connect people from anywhere to everywhere in the most efficient manner.

Southwest Airlines, surprisingly, opts for the point-to-point model rather than the hub-and-spoke model. The question arises: why does Southwest use an apparently less efficient system, and how do they remain profitable with it? This choice is primarily driven by the fact that the hub-and-spoke model has notable disadvantages that Southwest has strategically sought to minimize.

Southwest's decision to stick with the point-to-point model can be attributed to several key factors:

1. Simplicity and Efficiency: The point-to-point model aligns with Southwest's core principle of simplicity. It allows for more direct routes, faster turnarounds at airports, and simplified operations. This efficiency is crucial in reducing costs.

2. Faster Turnaround Times: Point-to-point flights enable quicker turnaround times between flights, which is one of Southwest's operational strengths. This means their planes spend less time on the ground and more time in the air, increasing overall efficiency.

3. Fare Flexibility: By operating a point-to-point system, Southwest can offer more flexible fares, including short-haul flights. Passengers benefit from more affordable ticket options, attracting a broad customer base.

4. Regional Focus: Southwest's focus on specific regions allows them to dominate markets efficiently. They can establish a strong presence in select cities, driving demand through frequent and convenient service.

5. High Frequency: Point-to-point flights allow Southwest to offer high-frequency flights on popular routes, contributing to customer loyalty and revenue.

While the hub-and-spoke model offers certain advantages, Southwest Airlines has strategically chosen to mitigate its drawbacks by embracing the point-to-point model. Their focus on efficiency, simplicity, and flexibility has allowed them to generate profits and maintain their unique position in the airline industry. This is how Southwest carefully choose their model and hit the spot of both cost and convenience which actually became turn them into a billion dollar profitable airline and this in turn gave them a ton of cash flow that kept them off load even during the times of crisis like 911 and even during the 2008 recession now the question is Southwest wasn't the only airline to use point to point model right there when other airlines too then why wouldn't those airlines as profitable as Southwest Airlines.

Southwest Airlines has harnessed a remarkable superpower known as "oil hedging." This tale traces its roots back to the tumultuous year of 1990, when the Gulf War was at its zenith. The conflict triggered a sudden and staggering 100% surge in oil prices in under a year. In the context of the aviation industry, fuel ranks as the second most exorbitant component in the supply chain. This juncture was of utmost gravity as the visionary CEO, Gary Kelly, astutely comprehended that the world stood on the precipice of another oil price surge.

In response, Southwest Airlines devised a strategy termed "oil hedging." In simple terms, it resembles an insurance policy for oil procurement. Southwest would engage in agreements with financial institutions, where they would pay a premium for their fuel today. In the event that oil prices were to skyrocket tomorrow, they would still be able to acquire their fuel at a predetermined price. For instance, if today's oil price stands at $25 per barrel, Southwest would secure it for $45 per barrel. Crucially, even if oil prices soared to $60 per barrel the next day, Southwest would steadfastly pay only $45 per barrel.

Commencing from 1994, Southwest initiated the practice of hedging, covering 20 to 30% of its fuel needs. By the year 2001, they had successfully hedged 100% of their fuel via their hedging platform. Astonishingly, this oil hedging strategy unveiled itself as a masterstroke. From 1998 to 2008, Southwest reaped the rewards, saving a colossal $3.5 billion compared to what they would have expended had they adhered to the industry's standard jet fuel prices. This $3.5 billion windfall constituted a remarkable 83% of their profits during the same period, spanning from 1998 to 2008.

While other airlines were hemorrhaging money in the aftermath of the 2008 oil price surge, Southwest Airlines basked in the glow of its profits, thanks to this astute strategy. This forms the second pivotal rationale behind Southwest Airlines' enduring profitability, even in the face of turbulent economic times.

In Southwest Airlines' core principles, the third and most important one is making both employees and customers happy.

In this company, when things get tough, everyone shares the difficulties, just like a close-knit family. This is how Southwest Airlines operates.

A good example of this happened after the 9/11 attacks. Many other airlines had to lay off a lot of employees, about 46,000 in total. But the CEO of Southwest, Jim Parker, chose a different approach.

He said, "We don't know what the future holds, but I promise you, your jobs are safe. We will keep paying your salaries, even though our planes are not flying."

At the same time, other airlines were not being very kind to their customers. They refused to give refunds and tried to find ways to avoid paying people back, because they were worried about losing money. But Southwest Airlines was different. They offered full refunds without asking questions. They showed great kindness, even when they were losing money.

What happened next is like a story from a legend. The decision to take care of employees and customers motivated the whole company to work together to get their planes back in the sky. When they got the green light to start flying again, the employees worked hard and solved problems that seemed impossible. They also worked to fix insurance issues. Flight schedules, which usually take a long time to make, were ready in just a few days.

Some employees even gave up part of their pay to help the company survive. They didn't take their profit-sharing, all because they were committed to protecting the company from financial losses. The maintenance crew worked tirelessly, often working 18 to 20 hours a day, with very little time off.

One heartwarming story shows the strong bond between Southwest Airlines and its customers. Some customers were so grateful for the airline's exceptional service that they gave the airline checks for a thousand dollars, just to help. It's like giving a significant amount of money to support a national airline.

All these acts of compassion, dedication, integrity, and unity helped Southwest Airlines navigate through the tough times after 9/11 and the economic challenges in 2008. From this inspiring story, we can learn some important business lessons.

The first lesson is that it's essential for a business to stand out and not just follow what everyone else is doing. Southwest's unique way of doing things, combining different strengths, is a great example of this. For investors, it's a reminder to look for strategies that set a company apart from its competitors, just like Southwest's approach.

The second lesson is about being prepared for hard times. Gary Kelly, a leader at Southwest, saw trouble coming and used an oil hedging strategy to help the company during tough times. For business owners, it's a reminder to identify and prepare for risks when things are going well, so your company can handle challenges better than others. For investors, it's about recognizing a company's strategies to stay strong in difficult situations.

Lastly, the most important lesson is that good leaders not only chase profits but also care about their employees and customers. Southwest Airlines' story is a shining example of this.