Japriz Dose #2

Metaverse, AI, GenAI, MarTech, Business, Chandrayaan, Robots, Adobe Analytics

Greeting esteemed readers, may this correspondence discover you in a state of well-being and brimming with fervor, and welcome to the spark of inspiration, collectively referred to as Journeying with Ambition, Purpose, Resilience, and Inspiring Zeal (JAPRIZ).

While Singapore celebrated National Day of Singapore on 9th Aug and India celebrated Independence day on 15th Aug'23 and I am happy to share monthly update in business, analytics, technology and other areas which sound important and I am thrilled to be working with each and every one of you to create insightful, engaging, and top-quality content for our readers.

Welcome to the September edition of our Japriz Newsletter! I hope you find this edition informative and inspiring. Let's dive in!

Spotlight

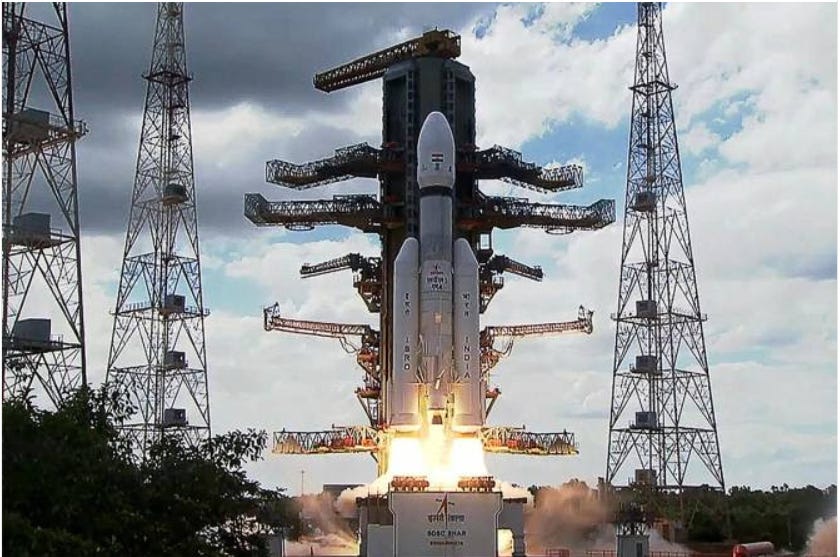

In a celestial orchestration witnessed on the 14th of July, 2023, precisely at 2:35 pm in the realm of Indian Standard Time, Chandrayaan-3 embarked upon its odyssey. With a strategic aim to rendezvous with the lunar south pole precincts on the impending 23rd of August, 2023, the lander and rover shall navigate the cosmic ballet.

Chandrayaan-3 is the third Indian lunar exploration mission under the Indian Space Research Organisation’s (ISRO) Chandrayaan programe. The mission consists of a lander named Vikram and a rover named Pragyan, similar to those of the Chandrayaan-2 mission. India has successfully landed its Chandrayaan-3 spacecraft near the Moon’s south pole on 23rd Aug'2022, a region believed to hold important reserves of frozen water and precious elements. This is India’s second attempt in four years to achieve this feat. With the Lander accomplishing a ‘soft landing’ on the Moon’s south pole, India becomes the only country to have ever done so. Now, a rover, which is a small vehicle that is meant to move around on the Moon’s surface, will come out of the Lander. The mission’s three objectives are to demonstrate a safe and soft landing on the lunar surface, to demonstrate a Rover roving on the Moon and to conduct in-situ scientific experiments.

The orchestrated descent, fueled by calculated physics, is earmarked for its grand overture on the 23rd of August, 2023, in the vesper hours around 05:45 pm , as marked by the cadence of Indian Standard Time when the Prime Minister of India was in Johannesburg at 15th Brics summit. Anticipations are high for the balletic culmination of this cosmic pas de deux, slated to grace the lunar stage, anticipated to occur on the same evening, near 06:05 pm, as etched in the sands of the hourglass of time.

The landing instantly became an immense source of national pride and signifies India’s prowess in launching high-quality moon missions with a Kirkland-level price tag.

The organization responsible for launching Chandrayaan-3, known as the Indian Space Research Organization (ISRO), operated with a budget of under $1.5 billion during the previous fiscal year. In contrast, NASA presently commands a budget exceeding $34 billion for its operations.

The private space industry in India, valued at $6 billion, is set to triple in size over the upcoming two years. This growth is attributed to the presence of space technology startups that draw inspiration from companies such as SpaceX.

Saudi Arabia, Argentina, Egypt, Iran and UAE to join BRICS on 1-Jan-2024

Worlds No 1. Mangnus Carlsen beats Praggnanandhaa. After a nail-biting set of matches spanning for the two days in draw and extending to two tie-breaks on 24th Aug-2023, the five-time world champion clinched the title and a prize $110,000 despite not keeping well due to food poisoning.

The fourth and final Grand Slam of the season - the US Open 2023 tennis tournament - is started on August 28 and final will be on September 10 in New York. All eyes will be on Serbian great Novak Djokovic, who will be returning to the Flushing Meadows after missing the tournament last year.

MarTech & Digital Experience

Adobe (Nasdaq:ADBE) announced the latest online inflation data from the Adobe Digital Price Index (DPI), powered by Adobe Analytics. July online inflation data is in, and it's the 11th consecutive month of YoY price decreases (-1.6%). Noteworthy declines in electronics (-11.7% YoY) & appliances (-8% YoY), while grocery increases slowed for the 10th consecutive month. Digital Price Index is powered by Adobe Analytics - analyzing 1T visits to retail sites & over 100 million SKUs. More Details>>

Metaverse

The realm of gaming is poised for expansion with the integration of metaverses into our daily routines. Designers have the ability to employ Adobe software such as Substance 3D and Aero for crafting collaborative immersive encounters and 3D digital elements. With the advancement of metaverse gaming, Adobe is dedicated to the enhancement of 3D and immersive creative tools, accessible to all for expressing their perspectives not just in gaming, but also in broader contexts.

Artificial Intelligence

The upcoming initiative from Google, code named Gemini, is poised to transform the field of AI. This project aims to process six or more diverse data types, paving the way for groundbreaking advancements like enhanced memory and strategic planning. Unlike a single standalone model, Gemini constitutes a collaborative network of AI models. This interconnected system is designed to proficiently manage a broad spectrum of tasks.

FraudGPT, an AI tool available through subscription, has been uncovered on the dark web. It allows even those without much experience to generate harmful code, malware, and deceptive phishing emails. This marks the dawn of a fresh age where weaponized AI is within reach and available to a wider audience.

Robots have already made their way into our homes in the form of Robot Vacuums, assisting us with cleaning. Check the advanced robots

Investment & Spinoff

Amid the Limelight on Fiscal Predicaments within the United States, Fitch Ratings' recent move to divest the U.S. government of its prestigious AAA credit rating serves as an emphatic underscore of the enduring and intricate challenges that confront the U.S. fiscal landscape. This decision, though, does not readily reveal itself as a driving force behind market dynamics; hence, its influence on the operational efficiency of the U.S. Treasury market remains undisturbed.

The relegation of the credit rating's stature emerges as a development that is improbable to incite substantial modifications within the macro evaluation framework of the Federal Reserve. Our perspective suggests that this occurrence neither triggers a shift in our projections concerning the trajectory of policy rates—expected to remain elevated for a prolonged period. As for the panorama of debt, it strengthens our conviction that the maneuvering space for central banks to elevate interest rates finds itself curtailed, thereby compelling them to coexist with a certain degree of inflation.

The aforementioned credit downgrade administered by Fitch trails behind the backdrop of a budgetary deadlock, an impasse that unfolded a mere two months prior and had the U.S. perilously proximate to a hypothetical default scenario. Fitch's demotion constitutes the second instance where the accolade of the U.S.' AAA standing was rescinded, a precedent initially set in 2011 by Standard & Poor's subsequent to a comparable standoff. It is worth noting that this context deviates significantly from the market and macro setting of 2011. Back then, policy interest rates lingered in close proximity to zero, deflationary perils were encroaching, and the eurozone grappled with a sovereign debt debacle.

The downgrade casts a spotlight on the reality that debt levels and interest rates presently soar to loftier heights in the aftermath of the policy response executed in the wake of the Covid pandemic, spanning the U.S. and fellow developed markets. Projections from the U.S. Congressional Budget Office (CBO) delineate a prolonged existence of a sizeable primary budget deficit in the U.S., an estimate which omits the inclusion of interest expenditures. Concomitant with this, the uptrend in interest costs ensues following the Federal Reserve's expeditious cycle of rate hikes. Our approximation indicates a near-doubling of U.S. debt servicing expenses across the impending five years, escalating to approximately $1 trillion, signifying 12-15% of the envisaged tax revenue. This trajectory appears poised to sustain the debt-to-GDP ratio on an unabated upward trajectory.

Consequently, this reality precipitates a proliferation in the issuance of government bills and bonds, both in the present and future. Such expansion compounds the inventory of Treasuries at a juncture wherein the Federal Reserve actively diminishes the heft of its balance sheet as part of a quantitative contraction strategy. This phenomenon stands poised to become a pivotal force exerting influence over the immediate trajectory of bond prices, coalescing with the tenor of Federal Reserve policy.

In summation, our derived inference emanates from the credit rating downgrade, instilling in us the conviction that the escalation of inflationary pressures coupled with mounting debt encumbrances shall progressively compel investors to demand augmented term premia. These represent a form of recompense for the peril entailed in holding extended-duration government debt. As a corollary, we anticipate the gradual steepening of yield curves within developed market (DM) bonds over time. This, in turn, corroborates our longstanding strategic inclination towards an underweight allocation. Pertaining to the DM equities domain, our tactical stance rests within the underweight spectrum, a positioning juxtaposed against our proclivity for an overweight orientation on a longer-term horizon. This preference is complemented by investments in inflation-indexed bonds, credit instruments, and enterprises poised to capitalize on structural megatrends.

Book Review

"Rich Dad Poor Dad," penned by Robert Kiyosaki, stands as an intellectually stimulating financial manual that subverts conventional precepts surrounding currency, investment, and the construction of affluence. Through its discerning anecdotes and pragmatic counsel, the tome emerges as a guiding light for those in pursuit of monetary sovereignty and a paradigm shift.

Kiyosaki artfully constructs his narrative upon the divergent viewpoints of two paternal influences: his biological progenitor (dubbed the "Impoverished Father") and the paternal figure of his dearest comrade (the "Wealthy Father"). This dichotomous portrayal affords readers the chance to delve into the underlying disparities within their fiscal and existential approaches.

The manuscript underscores the paramountcy of financial erudition and implores readers to liberate themselves from the cyclic grind of laboring for currency, directing their energies towards the endeavor of making currency toil in their favor. Kiyosaki introduces notions like assets and liabilities, underscoring the necessity of procuring revenue-generating assets capable of supplanting the need for a traditional vocation.

Among the foremost takeaways of the volume resides the importance of risk embracement and entrepreneurial ventures. Kiyosaki goads readers to venture beyond their zones of ease, to embrace adversity as an educational avenue, and to adopt calculated gambles in the pursuit of fiscal augmentation.

Furthermore, "Rich Dad Poor Dad" dispels widespread misconceptions about currency, for instance, the erroneous belief that a lofty income guarantees monetary stability. Instead, the author champions the cultivation of fiscal acumen, the comprehension of cash dynamics, and the act of making judicious choices grounded in sound fiscal tenets.

Throughout the book's entirety, Kiyosaki's prose remains alluring and accessible, ensuring that intricate fiscal tenets are dissected into palatable fragments suitable for readers of diverse backgrounds. His utilization of personal anecdotes and real-life illustrations endows the tome with relatability and compelling allure.

To conclude, "Rich Dad Poor Dad" surpasses mere financial literature; it metamorphoses into a manifesto for the transformation of one's perceptual relationship with currency and opulence. Kiyosaki's revolutionary ideas and motivational musings impel readers to embark upon a journey towards fiscal autonomy, armed with the sagacity and outlook requisite for the attainment of their fiscal aspirations. Whether an initiate in the realm of fiscal matters or a seasoned investor, this opus furnishes invaluable sagacity capable of reshaping one's fiscal destiny.

Case Studies

Explore Gillette's ingenious "razor blade model" strategy that sparked iconic brands, transformed markets, and offers entrepreneurial insights, shaping modern business success.

Upcoming Event

The 18th G20 Heads of State and Government Summit is scheduled on 9th-10th September 2023 in New Delhi, India.

The 10th World Sustainability Forum (WSF2023) will be a 24-hour hybrid event held in three locations, Singapore, Basel, and Toronto, on 14 September. WSF2023 is part of a global sustainability forum series that is organized by and supported by the MDPI, Sustainability Foundation.

Upgrade

Join the Adobe Analytics EMEA get together, register now

Adobe is offering free renewal of certification, also offers various resources and tools to help you renew your certification, in case your is expired this grab this opportunity. More Details»>

AI for Beginners - By Microsoft.Microsoft is offering a FREE AI course for beginners. It's a 12-week, 24-lesson course about Artificial Intelligence.

Migrating to OAuth, in case you are interested to know more then join the session Thursday, September 7